Environmental taxes in Canada, 2020

Released: 2023-12-13

$26 billion

2020

In the period from 2010 to 2020, governments worldwide launched more initiatives to fight climate change, build resilience to the changing climate and drive economic growth. In Canada, one of these initiatives was the Greenhouse Gas Pollution Pricing Act, which was implemented in 2019. This act established the framework for the federal carbon pollution pricing system. The revenue governments collected from these environmental taxes is reflected in the environmental tax statistics published today for the years 2019 and 2020.

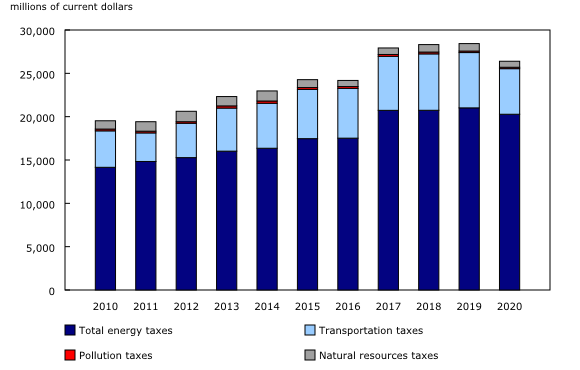

This period coincides with the first years of the COVID-19 pandemic, during which an economic slowdown was observed. The total environmental taxes generated in Canada reached $26 billion in 2020, down 7.2% from 2019.

The energy tax category represents three-quarters of environmental tax revenue

Of the $26 billion in total environmental taxes, $20 billion (76.8%) was attributable to energy taxes in 2020. An additional 19.9% was attributable to transportation taxes, 2.6% reflected natural resources taxes, and 0.6% was from pollution taxes.

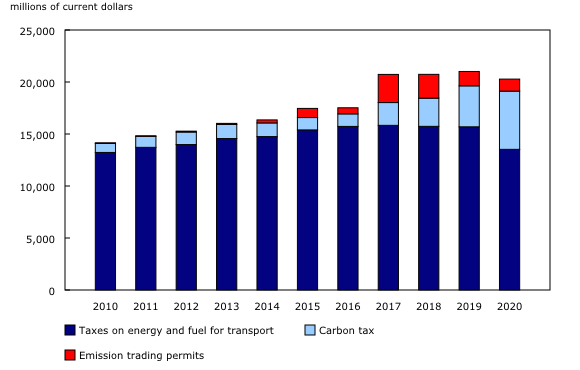

The energy tax category consists of three subcategories: the carbon tax, emission trading permits, and taxes on energy and fuel for transport. The share of the carbon tax within the energy tax category increased the most, from 18.7% in 2019 to 27.6% in 2020, because of the implementation of the Greenhouse Gas Pollution Pricing Act. In contrast, the share of taxes on energy and fuel for transport decreased the most, from 74.7% in 2019 to 66.7% in 2020. This reflects the impacts of the COVID-19 pandemic on consumer expenditure patterns.

The majority of environmental tax revenue comes from the industry sector

In 2020, the industry sector paid 53.4% of environmental taxes, followed by households (46.2%) and, in a much smaller proportion, investments (0.4%). The increase in the share of the industry sector was driven by the sector's share in the energy tax category, up from 79.3% in 2019 to 82.5% in 2020.

In 2020, households (26.9%) paid a larger share of taxes than the industry sector (13.4%) within the transportation tax category, which includes, for instance, personal motor vehicle registration.

Ontario accounts for the largest share of environmental taxes

In 2020, Ontario's contribution to total environmental taxes collected was 34.3%, followed by Quebec (19.2%), British Columbia (15.9%) and Alberta (14.3%).

Did you know we have a mobile app?

Get timely access to data right at your fingertips by downloading the StatsCAN app, available for free on the App Store and on Google Play.

Note to readers

The Environmental tax statistics (ETS) product provides annual estimates of environmental taxes in current dollars at the national level and by province and territory for the 2019 and 2020 reference years.

The ETS measures the revenue received by governments from environmental taxes paid by the industry sector (industries, government institutions and non-profit organizations) and households, as well as through gross fixed capital formation.

This product records transfers from businesses and households to government and does not record any returns, such as the carbon tax rebate that is received by households in some provinces.

Results for the ETS are in line with Statistics Canada's environmental taxes submission to the International Monetary Fund. Discrepancies arise mainly from presenting the ETS estimates by calendar year rather than by fiscal year.

The environmental tax amounts are reported for four main categories: energy taxes, transportation taxes, pollution taxes and natural resource taxes. Energy taxes can also be broken down into three subcategories: taxes on energy and fuel for transport, the carbon tax, and emission trading permits. The carbon tax is a tax charge placed on greenhouse gas emissions released mainly from burning fossil fuels. Taxes on greenhouse gas emissions other than carbon dioxide are also included. Emission trading permits enable government revenue to be recorded from the auctioning of emission permits (also known as "cap and trade"), which are treated as taxes on production in the national accounts.

Updates were made to data previously disseminated for the years 2013 to 2018, following a revision of commodities comprised in the transportation tax category.

Development of this product follows the United Nations System of Environmental-Economic Accounting 2012—Central Framework. For more information, see the page Canadian System of Environmental-Economic Accounts—Environmental tax statistics (ETS).

Definition

Environmental taxes: For the purpose of this product, environmentally related taxes are those whose tax base is a physical unit (or a proxy of it) of something that has a proven, specific, negative impact on the environment (as per the United Nations definition).

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: